How IRA Era HVAC Incentives Shifted for 2026: A Quick Overview

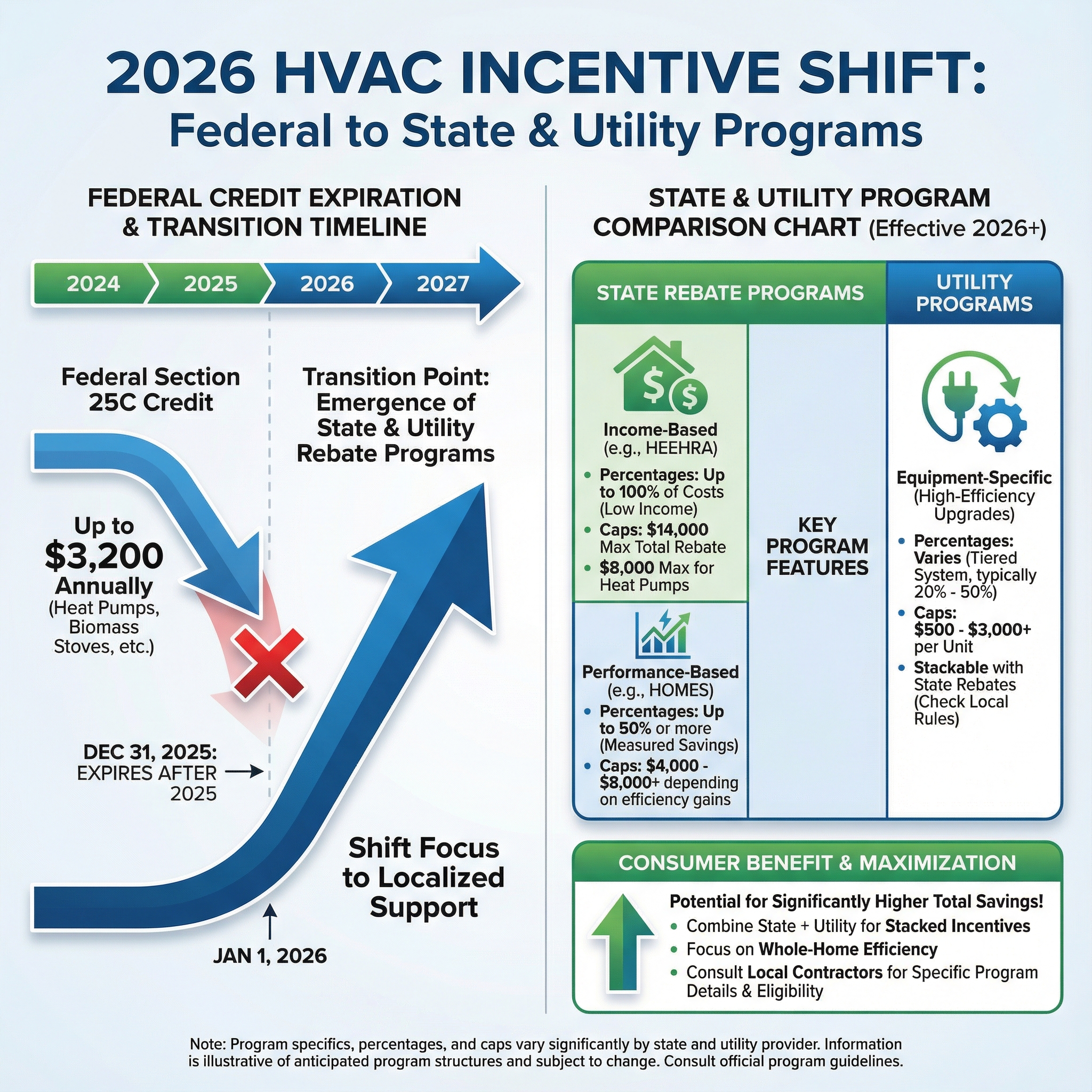

In 2026 the incentive map shifts from a familiar federal tax credit toward state and utility programs. The expanded federal Section 25C residential credit is authorized through December 31, 2026, and its 2026 status depends on updated guidance or legislation. As that phases out, large IRA funded state rebates and utility offerings become the primary support, rewarding deeper efficiency and electrification. Expect a patchwork by state: weatherized homes often unlock higher rebates, and qualification is tied to high SEER2 and HSPF2 tiers aligned with CEE and federal test standards. Utility programs continue to reference those IRA era thresholds. Think of it like moving from one interstate to many local roads, the destination is similar, but the route depends on your state and utility. Confirm eligibility and caps for your installation year, since IRS and state rules can evolve and some federal elements display 2026 end dates. Consult current IRS, DOE, CEE and state guidance, and consider a tax professional for final advice.

- Verify year specific eligibility and rebate caps.

- Confirm required SEER2/HSPF2 tiers for your model.

- Review whether weatherization affects rebate levels in your state.

Who Qualifies for 2026 HVAC Incentives: Income, Ownership, and Property Rules

Eligibility in 2026 for HOMES and IRA-linked rebates is set by each state, so income tests, property rules, and verification differ. Households at or below about 80% of Area Median Income are typically income-qualified, which can roughly double rebate caps. Define scope early, whether system replacement, fuel switch, or whole-home upgrade, and plan to place equipment in service in the year that aligns with federal credit windows and an active state reservation.

Have income documentation ready if you expect to qualify. Before you hire, ask contractors about CEE tier compliance, expected whole-home savings percentages, and their testing, commissioning, and documentation plan. From our field work, tight paperwork and timing prevent rebate delays.

Which HVAC Upgrades Qualify in 2026 (Heat Pumps, Mini Splits, Furnaces, Controls)

In 2026, incentives concentrate on high efficiency systems that cost more up front but cut bills and improve comfort. That means variable speed heat pumps, including ducted and ductless mini splits, and high SEER2 central ACs. Choose models that meet the Consortium for Energy Efficiency highest efficiency tier (non advanced) in effect at the start of the installation year. The IRA framework strongly favors heat pumps as the primary path to savings, and when the federal credit is active, qualifying projects can include labor costs. In our experience at Budget Heating (BudgetHeating.com), reviewers look closely at paperwork and commissioning, not just the nameplate rating.

- Eligible equipment: variable speed heat pumps and high SEER2 matched AC systems that meet the applicable CEE highest tier. Furnaces and controls may be part of a project, but heat pumps are the main focus for incentives.

- Required documentation: Manual J load, Manual S equipment selection, and Manual D for any ducted work.

- Provide the AHRI certificate showing SEER2, EER2, and HSPF2 ratings for the exact outdoor and indoor match.

- Professional installation is mandatory. DIY can void warranties and disqualify funding.

- Refrigerant work by EPA Section 608 technicians, with proper A2L handling.

- Electrical panel or wiring changes by licensed electricians with permits and inspections.

- Duct design, resizing, sealing, airflow balancing, brazing, and commissioning by qualified HVAC pros.

Common Pitfalls & When a Heat Pump May NOT Be the Best Choice

Heat pumps are versatile, but they are not universal fits. In our field work we see a few patterns that can derail performance, eligibility, or budgets.

- Extreme cold: In northern climates, choose cold climate rated models. In subzero stretches, add backup heat or consider a dual fuel setup or a high efficiency furnace to maintain comfort and reliability.

- Electrical limitations: Limited panel capacity or service can block installation. Upgrades take permits, time, and money, and may alter rebate eligibility. Think of the panel like a parking lot with only so many spaces.

- Incentive misfires: Do not assume the federal Section 25C credit beyond December 31, 2026. State and utility rebates vary by program, and many 2026-2027 tiers require insulation and air sealing first to unlock higher amounts.

- Specs vs eligibility: High SEER claims are not enough. Programs usually require CEE tier confirmation and AHRI documentation. Even if a federal credit sunsets, SEER2, EER2, HSPF2 and CEE benchmarks continue to drive local rules.

- Budget reality: High efficiency options often cost about 10% more upfront. If that is a barrier, stage upgrades, retain a furnace as backup, or choose a mid tier system.

How to Claim Federal Tax Credits: Step-by-Step for Homeowners

- Confirm current-year SEER2, EER2, HSPF2 and the CEE tier before purchase or install.

- Keep proof: itemized invoices, model numbers, AHRI or ENERGY STAR certs, manufacturer specs, commissioning reports, energy models, contractor CEE statement, permits, and inspection signoffs, often required for IRA incentives.

- Budget around caps: 25C historically 30% up to $3,200 total, with $2,000 for heat pumps or HPWH and $1,200 for other improvements. Confirm this year. HOMES ceilings vary by tier and income.

- After install, promptly submit state or utility rebate forms.

- File IRS Form 5695 with your return and keep all records.

Incentive Types Explained: Federal Tax Credits vs. Point of Sale and State Rebates

Tax credits and rebates work differently. A federal credit is claimed on your tax return, reducing tax owed dollar for dollar in the following year. The Energy Efficient Home Improvement Credit (25C) typically covers 30 percent with an annual cap around $3,200, up to $2,000 for heat pumps or heat pump water heaters, and up to $1,200 for other eligible improvements. Current IRS language limits enhanced 25C through December 31, 2026, so check guidance for 2026. State or utility rebates and point of sale discounts lower your invoice now. Think of a credit as money back at tax time and a rebate as a coupon at checkout.

Accounting basics: do not claim a credit on amounts already rebated. In general you do not subtract state or utility rebates from the federal cost basis unless they are purchase price adjustments such as direct point of sale discounts. Some rebates may be taxable income. Stack carefully and secure any required pre approval or reservations before installation. In our experience at Budget Heating (BudgetHeating.com), lining up paperwork early prevents surprises. Confirm how your specific rebate is treated for income and basis.

2026 Incentive Amounts and How Income Tiers Affect Payments

In our experience, the headline incentives in 2026 center on HOMES performance-based rebates. If a modeled retrofit shows 20 to 35 percent whole-home savings, the rebate typically covers 50 percent of project cost up to $2,000. Push modeled savings past 35 percent and the cap rises to 50 percent up to $4,000. There is also a measured pathway that pays per kilowatt-hour saved, up to $2,000. Income matters: households under roughly 80 percent of area median income usually see those limits roughly doubled, which can turn a deep retrofit from aspirational to attainable.

We also see state and utility offers go further in 2026 to 2027, with flat rebates around $15,000 for ground-source whole-home systems, up to $25,000 for income-qualified projects, and up to $16,000 for certain air-to-water systems. Stack that with bill cuts from higher efficiency and the math tightens. Upgrading from an older SEER10 to SEER13 system to a high-SEER2 unit often trims $300 to $900 per year, and moving from SEER2 15 to SEER2 20 can add about $200 per year in high-rate regions. Think of rebates as an instant coupon: combine them with annual savings and simple payback can compress to a few seasons in big-load homes with high energy prices.

Energy Performance Standards (SEER2/EER2/HSPF2) and Certification Requirements

In 2026, efficiency ratings remain the common yardstick for codes, rebates, and labels. The 2023 test methods stay in force, so equipment is rated under SEER2, EER2, and HSPF2. SEER2 is a seasonal cooling score measured under higher external static pressure than legacy SEER, so the numbers are lower; always compare SEER2 to SEER2. EER2 captures steady state efficiency at a specific outdoor temperature, which matters for peak days and demand response. HSPF2 is the heating season metric for heat pumps.

Typical ranges: baseline systems around 14 to 15 SEER2, mid tier 16 to 17, and high efficiency variable speed units 18 to 22+. ENERGY STAR central AC starts near SEER2 15.2 with added EER2 criteria. As a reference point, recent tax credit rules set split systems at SEER2 17.0 with EER2 12.0 and packaged units at 16.0 with EER2 11.5. Many state and utility programs cluster around those thresholds, aligning with CEE highest non advanced tiers, and they continue to do so even if a federal homeowner credit sunsets. Several leading states are also tightening 2026 codes, bringing heat pumps into prescriptive baselines and requiring better commissioning and ventilation.

What the numbers mean: moving from SEER2 14 to 17 can trim cooling use about 18 percent, and SEER2 20 can be roughly 30 percent lower than a SEER2 14 baseline in cooling dominant climates. Replacing older SEER 10 to 13 systems commonly saves about 300 to 900 dollars per year. Think of SEER2 like miles per gallon for cooling, but measured on a tougher driving cycle.

How to Apply for Upfront/Point-of-Sale Rebates and Stay Safe During Installation

Start rebates with a state-approved or BPI energy assessment. HOMES measured-savings pay per kWh saved, require pre and post metering, and may cap at $2,000. From March 1, 2026, higher tiers reward weatherize first, then right-size. Request pre and post duct tests, itemized invoices for duct, insulation, and electrical work, and keep records. DIY only basics: replace filters, clear the outdoor unit, rinse coils, program the thermostat. Always de-energize, never vent refrigerant, avoid attic or roof work, call a pro for leaks. Watch for icing or short cycling. Plan pro tune-ups yearly, ideally twice.

Next Steps: Check Eligibility, Get a Quote, and Find Certified Installers

High-SEER2/HSPF2 heat pumps or central AC remain 2026 cornerstones. To maximize incentives, go whole-home: seal and insulate first, right-size, verify commissioning. Confirm current federal credits, engage your state energy office and utility early, and time your project with rebate reservations. HOMES and HEEHRA help income-qualified households, and some states offer roughly $15k to $25k for ground-source and up to $16k for air-to-water. Demand CEE tier, AHRI, Manual J/S/D, and keep all records.

If this feels complex, our 30+ years make it simple. We match qualifying equipment and certified installers.

- Get a Custom Quote

- Talk to Our Team by phone

- Shop Heat Pumps

learning center

learning center

Cooling

Cooling Heating

Heating Money Saving Tips

Money Saving Tips Product and Brands Insights

Product and Brands Insights Buying Guides

Buying Guides State by State

State by State HVAC Systems

HVAC Systems