HVAC Financing for Bad Credit or No Credit: What this Guide Covers

HVAC breakdowns rarely wait, and fixes are costly. Because heating and cooling affect comfort, safety, and utility bills, many providers and lenders offer pathways that can approve borrowers with bad credit or no credit.

We explain what counts as HVAC financing: any plan that spreads equipment or repair costs over time. That includes no-credit-needed and lease-to-own programs, dealer-arranged financing, online lender marketplaces, and property assessed or government backed options. Our aim is practical: set clear expectations, show where approval is more likely, and outline tradeoffs so a workable route is within reach.

Can You Finance HVAC with Bad or No Credit? Quick Overview of Benefits

Often, yes. Many programs look beyond FICO, using income stability and banking history, and some offer soft pull prequalification that does not affect your score. Key benefits: little or no upfront cash, coverage for the full installed cost (equipment, labor, permits), flexible terms with low starting payments, and fast online applications with instant decisions and funding as soon as the next business day. Longer terms lower the payment but raise total interest.

- Decide repair or full replacement.

- Set a total budget and target monthly range.

- Check soft pull prequalification.

- Gather income and banking details.

- Confirm which project costs are covered.

Top Financing Options When Your Credit Is Poor or Nonexistent

When credit is thin or bruised, you still have paths to replace a failed system. The main buckets are lease-to-own or rental agreements, unsecured personal loans from online lenders, buy-now-pay-later and rent-to-own arrangements, and dealer or in-house programs.

- Lease-to-own or rental: Approval often requires minimal documentation. The provider owns the system at first, and you gain ownership after scheduled payments or an early purchase. Decisions are typically fast, which helps when heat or cooling is down. Many plans include a 6 to 12 month early purchase window that can cut the overall cost if you pay the balance within that period.

- Unsecured personal loan: Fixed-rate, fixed-term loans that can fund quickly through marketplaces and online lenders. A good fit if you can secure a reasonable rate despite imperfect credit and prefer one predictable monthly payment.

- Buy-now-pay-later and rent-to-own: Alternative routes for subprime or thin-file borrowers. BNPL breaks costs into set installments, while rent-to-own mirrors lease-to-own mechanics.

- Dealer or in-house programs: Keep everything with one provider. Terms vary, but convenience can be the draw.

Loan vs lease, simplified: with a loan, you borrow funds and repay a lender on a fixed schedule. With a lease-to-own, you make scheduled payments to the provider who owns the equipment until you exercise purchase or complete the term. Think of it like renting with a path to buy. In our experience at Budget Heating (BudgetHeating.com), families often pick lease-to-own for emergency replacements because approvals and decisions move quickly, and the early purchase option can meaningfully reduce the total cost if you can pay off within 6 to 12 months.

In-House Contractor & Promotional Financing: How Dealer Programs Work

Dealers and manufacturers often offer captive financing with teaser promos, like 0 percent for 12 months or deferred interest, paired with higher base APRs for weaker credit. The promo can be a good fit if you plan your payoff, but fine print controls fees, compounding, and what happens if you miss a step. In our experience at Budget Heating (BudgetHeating.com), these plans work best when the job timeline and payment schedule are locked in.

Before you apply, confirm with your contractor, like a preflight checklist:

- They are approved for the program, will pull permits, follow code, and register equipment warranties.

- How utility or manufacturer rebates are handled, assigned to reduce the invoice today or paid to you later, since that changes your payoff plan.

- When the promo converts to the standard APR, when payments start, and whether autopay is required for same as cash terms.

Read the fine print before you sign.

How to Improve Approval Odds Quickly: Documents, Down Payments, and Application Checklist

- Prequalify with a soft pull via marketplaces. Have pay stubs, bank statements, ID, proof of residence, and a checking account ready.

- Limit hard pulls: ask soft vs hard and use a cosigner if available. List any down payment on the application.

- Confirm funding: who is paid, staged draws, and an itemized install contract with model numbers, scope, dates, and a change-order policy.

- Credit and repayment: ask if payments are reported, on-time builds credit and missed hurts; use autopay for discounts, check first statements, and, if allowed, pay extra principal or use early purchase windows.

When Financing Might Not Be the Right Choice: Red Flags, Tradeoffs and Honest Alternatives

With 30+ years in HVAC, we have seen financing help and hurt.

- Selling or refinancing soon? Avoid PACE and some equity options that create tax-like liens. Closings can stall. Better: wait and save, or use a low-rate personal or credit-union loan.

- Deferred-interest promos. Miss the window and interest posts retroactively. If payoff is unsure, choose a fixed APR.

- No-credit-needed plans. Some exclude your state. Confirm before applying.

- Wrong system choice. Bigger is better and yearly refrigerant top-offs are myths. Oversizing and topping leaks raise lifetime cost, especially when financed.

For small emergencies, a short bridge you plan to refinance can work, but watch card APRs and fees.

Credit Unions, Local Lenders & Personal Loans That Work with Low Credit Scores

In our experience, credit unions and community banks are often the most forgiving traditional choice for low credit scores. Their underwriting can be more flexible, and many offer personal loans or member programs aimed at essentials like HVAC replacements. Use soft pull prequalification from a few lenders or marketplaces to compare offers without affecting your score. Unsecured marketplace personal loans are fixed rate and fixed term, commonly $1,000 to $50,000. Rates are higher with poor credit, yet can still be cheaper than high-fee financing or revolving cards when the term fits your budget. Evaluate total cost, not just payment: APR, term, origination fee, and any prepayment penalty. Shorter terms raise the payment but usually cut interest paid overall.

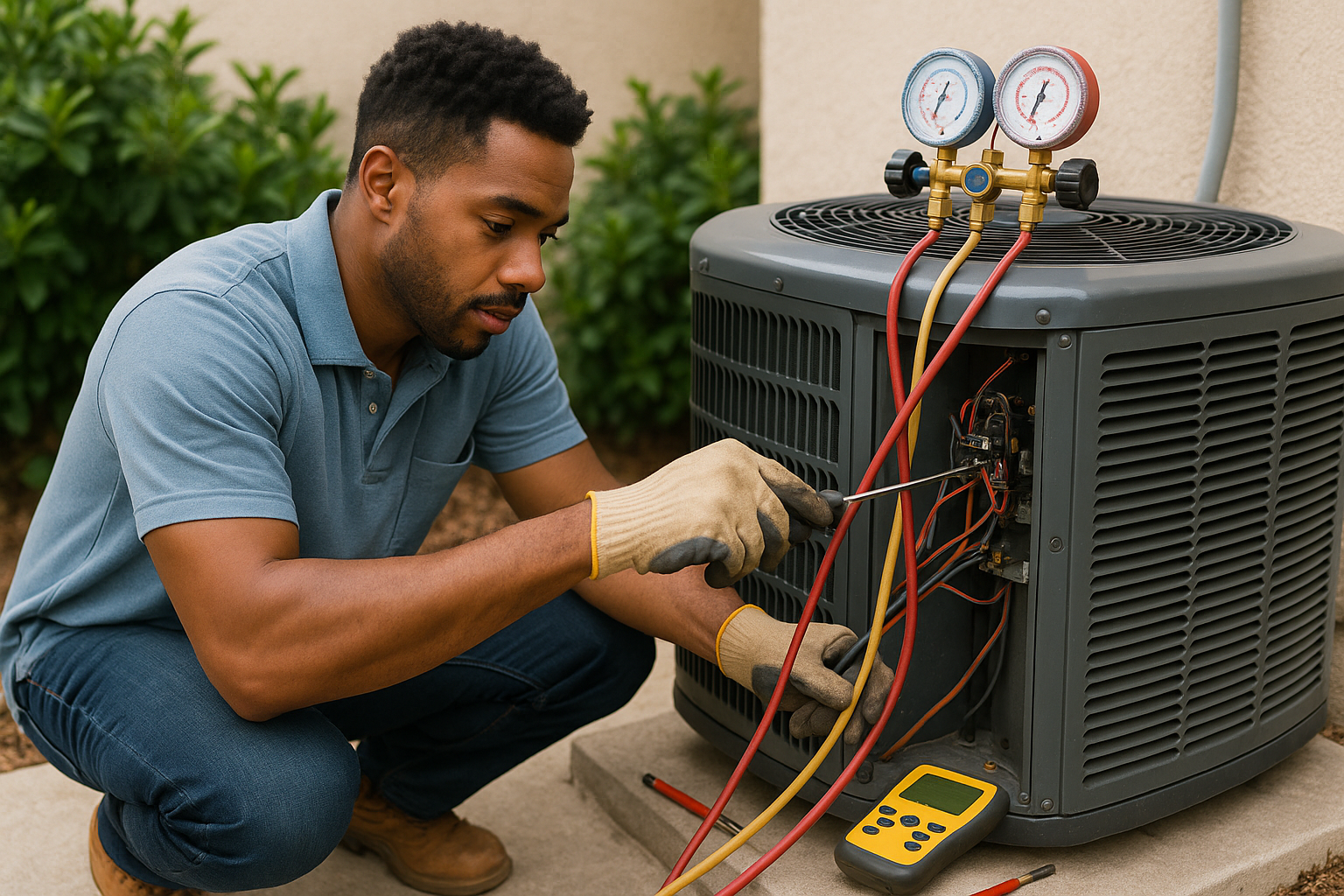

Secured Options, Safety & Maintenance: Risks of Liens and How to Care for a Financed System

Secured options like home equity, title loans, or PACE-style programs may lower rates but place liens or tax-style assessments that affect sale or refinance. Protect investment and warranty: leave electrical, refrigerant, gas, and major mechanical work to licensed techs. Do owner tasks only: change filters every 1-3 months, keep 2 ft clearance, rinse coils with power off, check condensate drain. Financing expects permitted, code-compliant work; skipping service risks bigger failures during repayment.

Estimated Costs, Monthly Payment Examples and Efficiency Tradeoffs (Calculator Guidance)

From what we see every day, unsecured HVAC loans commonly range from $1,000 to $50,000, while lease‑to‑own approvals often cap near $12,000 with advertised payments starting around $99 per month. Many lenders use a soft inquiry for prequalification and charge no application fee, with funding in roughly 1 to 10 days.

Compare offers by APR, term, total of payments and fees, then layer in rebates, tax credits and expected energy savings. Quick math: $8,000 financed at 24% for 84 months is about $198 per month. A lower APR can drop that meaningfully. Avoid relying on high‑APR credit cards, many exceed 20% and some contractors add up to a 5% processing surcharge.

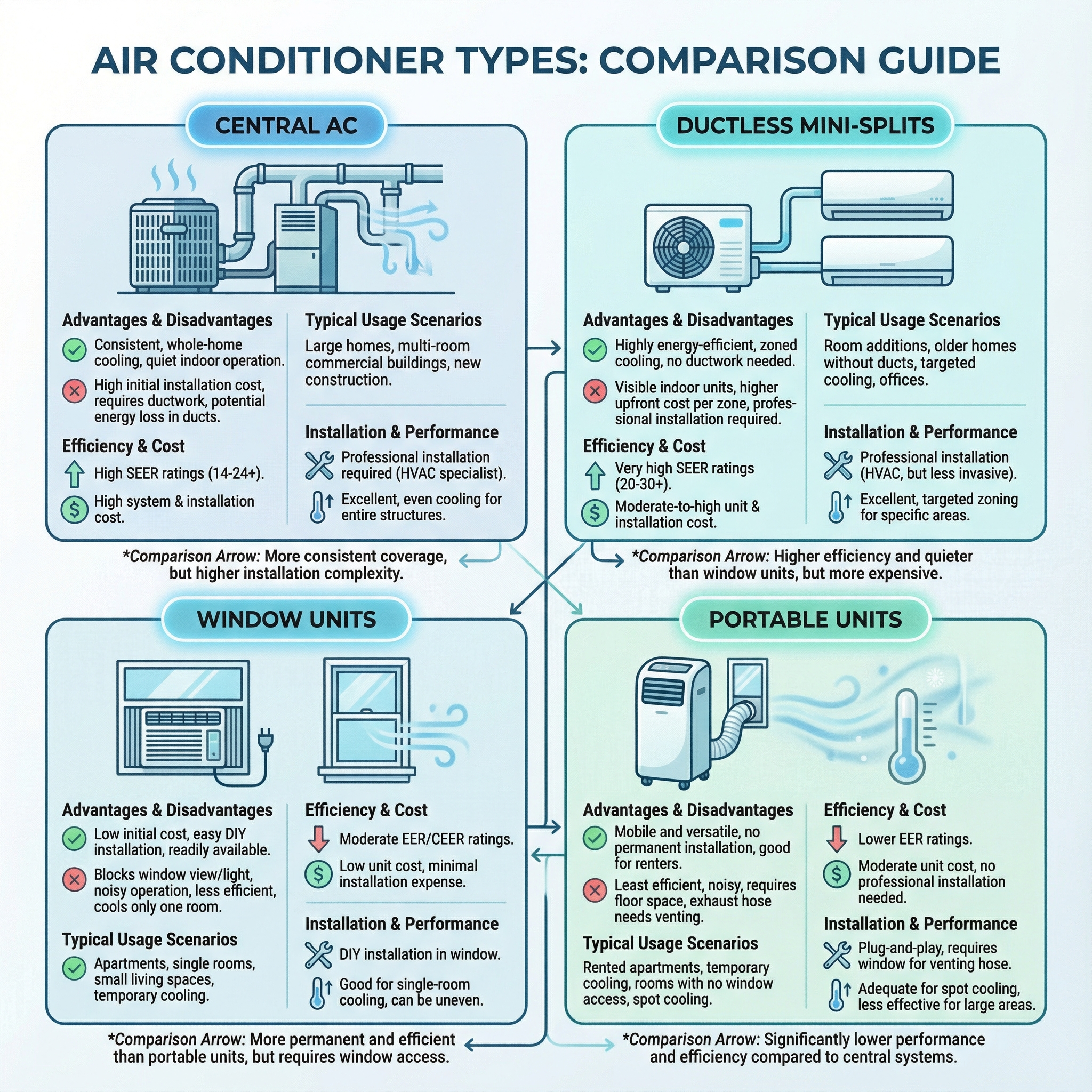

Efficiency drives operating cost. Since 2023 equipment is rated under SEER2, confirm quoted gear meets DOE minimums and any rebate rules before financing. Going from 14 to 16 SEER cuts cooling use roughly 12 to 13%, and 14 to 20 SEER can trim about 30%, which can offset a portion of the monthly payment.

Next Steps: Apply, Compare Offers, and Protect Yourself

Even with bad or no credit, you have more HVAC financing paths than before, each with tradeoffs in cost, flexibility, and risk. Treat this like an integrated investment: get 2-3 bids, verify proper sizing and permits, and factor in efficiency, rebates, and how payments are reported. Prequalify via soft-pull marketplaces, compare total of payments and fees, confirm permits and warranties, and consider early payoff or refinancing to cut long-term cost. We know replacements are urgent, and our team can help you act quickly without skipping protections.

- Get a Custom Quote

- Talk to Our Team, phone support available

- Shop HVAC Systems